The August Fund Manager Survey takes a look at machine learning and artificial intelligence (AI). After many false starts, these disciplines are having a big impact on every aspect of business that is data driven and are finding advocates in the trading and investing realms. We queried hedge fund managers and CTAs and asked for their opinion and position in this area; here are the findings.

Over 50% of fund managers surveyed by BarclayHedge say that they are either taking a wait-and-see approach or have no interest in machine learning (ML) and artificial intelligence (AI).

The survey also found that 20% already utilize AI and ML while an additional 16% are actively researching their utility.

“Given the common perception that AI and machine learning are going to shape the future, the results of the survey may look surprising on the surface,” says Sol Waksman, founder and president of BarclayHedge. “But change is going to come slowly to alternative management because there’s still a learning curve that needs to be mastered, regardless of whether it’s a machine or human doing the learning.”

Large Funds and New Managers Have Been Embracing AI and ML

Following the success of firms such as Renaissance Technologies and Two Sigma, many large hedge funds have increased their interest and participation in AI and ML. Industry stalwart Man Group Plc recently announced that they were expanding the use of AI in a number of funds which manage a total of over $12 billion and Protege Partners launched MOV37, which will invest solely in start-up investment funds that employ artificial intelligence. From outside of the industry, Eric Schmidt, the executive chairman of Google's parent, Alphabet, recently told a group of hedge fund managers that in 50 years no trading will be done without computer assistance.

“Artificial intelligence and machine learning may be the way of the future but the reality on the ground right now is different,” says Waksman, “All types of businesses, from taxis to hotels to music, have been disrupted by technology and there’s a common perception that investing and trading will also be affected. That may be true but it’s going to take time for the shift to occur.”

Q1: What is your firm's approach to machine learning and AI?

20% — We have already utilized them

16% — We are actively researching their utility

13% — We intend to look at this area within the next year

15% — We are taking a wait-and-see approach

36% — We have no interest in this area

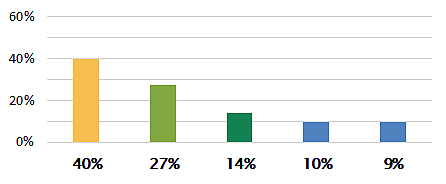

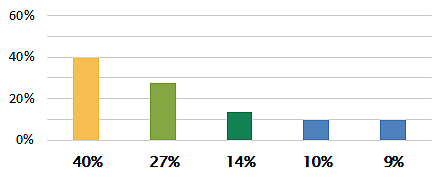

Q2: In what area of your business might machine learning and AI be most applicable?

40% — Refining existing strategies

27% — Researching new strategies

14% — Risk management

10% — Investor research and marketing

9% — Other*

*If anything, AI generated algo's will be our counterparty when the market turns volatile

Both refining existing strategies (primary) and researching new strategies (secondary)

No interest

None

In my business machine learning, AI and neural networks do not work

None

I do not believe that AI is better at asset management, trading and risk management than I am

Note: The BarclayHedge survey was conducted between August 14 and August 30, 2017. We surveyed hedge fund managers and commodity trading advisors that currently provide performance data to the BarclayHedge suite of database products. Ninety-three managers responded.