“The inflows we saw in August could not mask the troubles facing the hedge fund industry this year,” said Sol Waksman, founder and president of BarclayHedge. “While the industry had inflows in four of the first eight months of 2012, much stronger outflows in the other four months yielded net redemptions of $13.2 billion (2.0% of assets) year to date.”

In addition to losing assets this year, the hedge fund industry continued to underperform the benchmark S&P 500, gaining 1.05% in August while the S&P 500 rose 1.98%. For the first eight months of 2012, the industry earned a 4.2% return while the S&P 500 rose 10.1%.

Of the 13 major hedge fund categories that TrimTabs and BarclayHedge track, Fixed Income funds attracted the most assets in all three time horizons measured in the report: monthly, year-to-date, and over the past 12 months. Fixed Income funds also had the best 12-month returns at 7.1% and the second-best YTD returns at 6.2% (Convertible Arbitrage funds came in first at 6.8%).

“Fixed Income funds significantly bested the hedge fund industry average of 1.3% for the past 12 months,” said Charles Biderman, founder and CEO of TrimTabs. “We cannot help noting that while the S&P 500 rose 15.4% from September 2011 to August 2012, the best stock-based hedge fund strategy, Equity Long Bias, produced a meager 2.0% return. As an industry, hedge funds seem to have lost their touch in the stock market.”

Also in August, funds based in Continental Europe had the largest inflows at 0.6% of assets while China/Hong Kong funds and Japan-based funds had the largest outflows at 0.6% of assets for each category. “It appears investors were unloading Asia funds and investing them in hope of tapping a rebound in euro-denominated securities, which took a strong beating in the debt-crisis sell-off earlier this year,” said Leon Mirochnik, Vice President at TrimTabs.

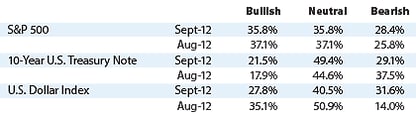

Meanwhile, the September 2012 TrimTabs/BarclayHedge Survey of Hedge Fund Managers found that sentiment was evenly divided between neutral and bullish on the performance of the S&P 500 for October. Conducted in late September, the survey of 81 hedge fund managers also found that a majority expect Barack Obama to be re-elected and an even stronger majority expect control of Congress to remain divided.

The TrimTabs/BarclayHedge database tracks hedge fund flows on a monthly basis. The TrimTabs/BarclayHedge Hedge Fund Flow Report provides detailed analysis of these flows as well as relevant topical studies. Click here for further information.

BarclayHedge is a leading hedge fund data vendor and one of the foremost sources for proprietary research in the field of alternative investments. From its origin as a research specialist and performance measurement firm, BarclayHedge has developed complete client services as a publisher, database and software provider, and industry consultant.

TrimTabs Investment Research is the only independent research service that publishes detailed daily coverage of U.S. stock market liquidity--including mutual fund flows and exchange-traded fund flows--as well as weekly withheld income and employment tax collections. Founded by Charles Biderman, TrimTabs has provided institutional investors with trading strategies since 1990. For more information, please visit us here.