February’s spike in volatility prompted nearly half (42.1%) of investors to adjust their equity market outlook, according to the results of the BarclayHedge, MPI Volatility Angst Survey. Investors also cited rising rates and growing geopolitical tension as cause for concern in the year ahead.

More findings of the Q1 2018 survey, in a nutshell:

- If volatility stays high, investors say they are most likely to lean on diversification across asset classes, strategies, and alternatives.

- Most investors think managed futures provide a viable diversification option in volatile markets.

- Three of four respondents indicate that hedge fund fees are still too high.

The survey also notes anxieties over trade policy, geopolitical risk, and the efficacy of managed futures for risk management.

Now, let’s dive into the details of the survey.

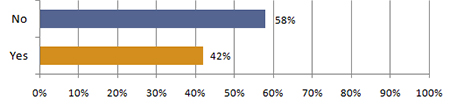

Q1: Did spiking volatility in February change your equity market outlook?

Investors were queried more than six weeks after the VIX saw its largest-ever one-day move, plenty of time for pulses to return to normal. Though a slim majority followed the standard advice to not read too much into short-term swings in the equity market, nearly half revised their equity market outlook in response to the spike.

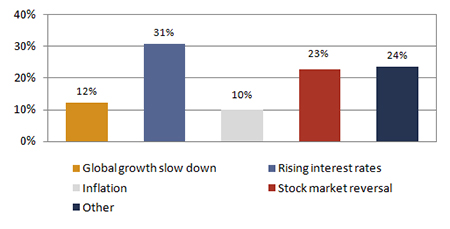

Q2: What do you think poses the greatest market risk over the next 12 months?

The majority of respondents (53.5%) cited rising interest rates or a stock market reversal as posing the biggest risk for investors in the year to come. Slowing global growth (12.3%) and inflation concerns (10.5%) were also listed as risks.

Investors were also asked to name other high-level risks we left out of our four options. Almost all of the “other” responses, 21 percent of respondents, cited unease with the Trump administration, trade policy or geopolitical uncertainties.

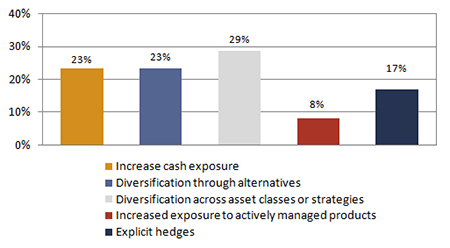

Q3: What portfolio adjustments would you prioritize if volatility is sustained?

The investors that were surveyed expect to lean heavily on diversification, with a slight preference for spreading bets across asset classes or strategies vs. investing in alternatives. Notably, hardly anybody wants more exposure to actively managed strategies.

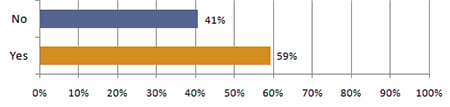

Q4: Managed Futures have typically provided diversification through market corrections, but failed to do so in February. Do you believe that Managed Futures can still provide portfolio diversification in market drawdowns?

It’s no surprise that nearly six out of 10 respondents recognize the power of Managed Futures to use algorithms that enable sophisticated bets against broad market trends, which can help manage risk more effectively than conventional investing. That’s the whole rationale behind CTAs, after all.

Still, four out of 10 respondents question the diversification benefits of Managed Futures; their skepticism could be warranted, given that CTAs took a pounding in February that generated headlines across the financial world.

Q5: What is your current view of hedge fund fees?

Volatile markets underscore the appeal of investing with hedge funds and other alternative vehicles, which often charge high fees in exchange for protection from market gyrations. So, we asked for investors’ thoughts on fees.

Three out of four respondents (74.3%) said fees are still high or that they wanted to see them come down further, while only a quarter of them (25.7%) were satisfied with current fees.

Survey Methodology

The BarclayHedge, MPI Volatility Angst Survey went out to 4,414 institutional investors between March 28 and April 3, 2018. We received 164 responses from people working in funds-of-funds, multi-advisor futures funds, family offices, financial institutions, pensions, endowments, institutions, and other specialties. Respondents also included financial planners, wealth managers and registered investment advisers. Respondents were asked to select one answer for each question.

About BarclayHedge

Sol Waksman is the founder and president of BarclayHedge. Waksman is an industry expert and experienced media source, providing perspectives on hedge fund and managed futures trends. BarclayHedge is the global leader in providing independent, research-based information services to the alternative investment industry. Founded in 1985, Barclay currently maintains data on more than 6,800 hedge funds, fund of funds, and CTAs. No one has been in the business of collecting alternative investment data longer than BarclayHedge. Institutional investors, brokerage firms, and private banks worldwide utilize BarclayHedge indices as performance benchmarks for the hedge fund and managed futures industries.

About MPI

Markov Processes International (MPI) is a leading independent provider of quantitative investment research, technology and analytics for the global investment management industry. MPI’s flagship Stylus solutions are used by hundreds of firms to make smarter investment research, portfolio construction and optimization, performance analysis, risk surveillance, distribution and reporting decisions. MPI Stylus can be delivered as a desktop, enterprise-hosted or cloud-deployed solution. MPI’s Enterprise Solutions team also offers customized configuration and implementation services to meet your organization’s specific needs. For more than 25 years, MPI has been a trusted, transparent and objective investment technology and insights partner to the world’s leading pensions, endowments, sovereign wealth funds, wealth management firms, hedge fund managers, fund of hedge fund managers, institutional consultants, investment advisors, asset managers and securities regulators. Follow us on Twitter @MarkovMPI, connect with us on LinkedIn and read the latest MPI research.