Little Expectation that Gains Will Be Shared Broadly

A new survey of institutional investors and hedge fund managers found that nearly seven in ten survey participants expect that equity markets will rise if tax reform is enacted by the U.S. Congress. An even greater percentage expect that budget deficits will also rise. In addition, only 12% of managers and investors believe that corporations will use their tax savings to expand operations or add jobs.

“Fund managers and investors are strongly bullish when it comes to how tax reform would help equity prices,” says Sol Waksman, founder and president of BarclayHedge. “But, at the same time, there is little belief that the current tax reform proposals will improve the deficit or be used to grow the economy in general.”

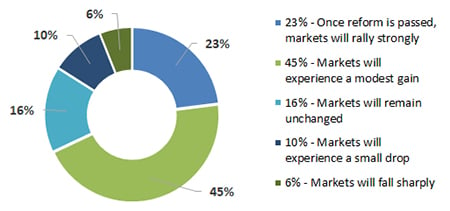

Survey participants were asked their opinion on what would happen to equity markets if the president received what he wants in the tax bill and 68% expect the market to gain. The greatest percentage (45%) expect a modest gain with a significant number (23%) calling for a strong rally. Only 16% expect either a small or sharp drop in prices while 16% called for no change.

Q1: Assuming that the president gets what he wants on the tax bill, what do you believe will be the impact on U.S. equity markets in the short term?

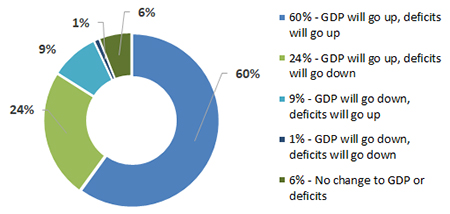

With regard to GDP and the deficit, 84% predict that GDP will rise and 70% expect that the deficit will increase. 25% of managers and investors expect that deficits will fall while a final 6% call for no change to either GDP or the deficit. Only 1% expect that both GDP and the deficit will fall if tax reform is passed.

Q2: What do you think the impact of tax reform will be in the U.S. with regard to the deficit and GDP growth?

Tax Reform Not Expected to Boost Hiring

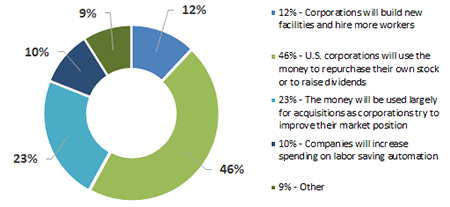

Survey respondents were also asked how they expected companies to apportion their tax savings. Almost half of the respondents (46%) expect corporations to repurchase their own shares or raise dividends and 23% expect increased mergers and acquisitions; 9% expect an increase in automation.

Only 12% of those polled believed that corporations will expand their facilities or hire more workers with their tax savings. 9% offered miscellaneous responses that could not be categorized.

Q3: If the U.S. corporate tax rate goes down to 20%, where do you think companies will spend most of the tax savings?

Respondents were given the option of submitting written answers in response to Q3 and their comments were:

- The management will enrich itself as has been the case in the last twenty years with outsized, obscene renumeration packages where the top managements' performance is mostly irrelevant in the final payouts. In light, of that there will be increased buybacks of their shares. So- called tax reform is a mirage since effective tax rates are around 19-20% already. Example: Google/Alphabet tax rate in 2016 was 17%, Eli Lilly 16%.

- Executives' pockets.

- All of the above.

- All of the above. Depends on the specific corporation.

- Will be spent evenly across business proportionally with current spending.

“While managers and investors expect that the adoption of tax cuts will have a positive impact on the markets and GDP, they do not believe by a long shot that these gains will result in increased investment in plant and equipment or a rise in employment,” says Ole Rollag, Managing Principal of Murano Systems. “This could be problematic for Congress, which is likely to be sensitive to any perception that tax reform will not benefit the great majority of Americans.”

Note: The survey of 113 hedge fund managers and large investors was conducted simultaneously by BarclayHedge and Murano Systems between October 17 and October 31, 2017.