Fund fees have been coming under pressure from investors. In order to get a clearer picture of how fund managers are responding, we've asked two questions on the topic.

This month's survey of hedge fund managers revealed that 36.6% of survey respondents currently offer reduced or no fee alternatives to their investors and a further 20% plan to offer lower or no fee products in the next 3 to 6 months.

“The hedge fund industry has been under pressure to offer lower fee alternatives for some time,” said Sol Waksman, founder and president at BarclayHedge. “We expect that these pressures will continue and that low or no fee products will continue to grow."

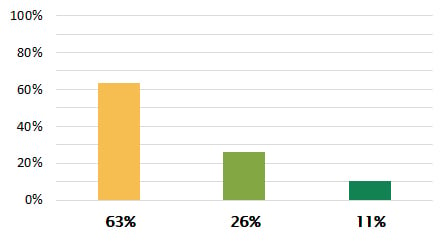

Q1: Do you currently offer a product that offers reduced or no incentive fees?

63% — No

26% — Yes, currently offer products with reduced incentive fees

11% — Yes, currently offer products with NO incentive fee

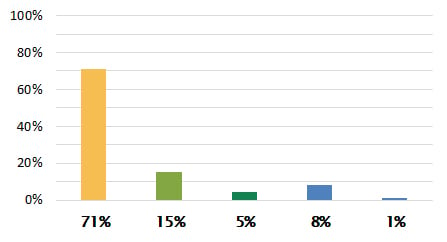

Q2: Do you plan to offer a product within the next 12-months that will offer reduced or no incentive fees?

71% — No

15% — Yes, reduced fee in 3 - 6 months

5% — Yes, zero fee in 3 - 6 months

8% — Yes, reduced fee in 6 - 12 months

1% — Yes, zero fee in 6 - 12 months

Note: The BarclayHedge survey was conducted between July 17 and July 28, 2017. We surveyed hedge fund managers and commodity trading advisors that currently provide performance data to the BarclayHedge suite of database products. One-hundred thirty-four managers responded.